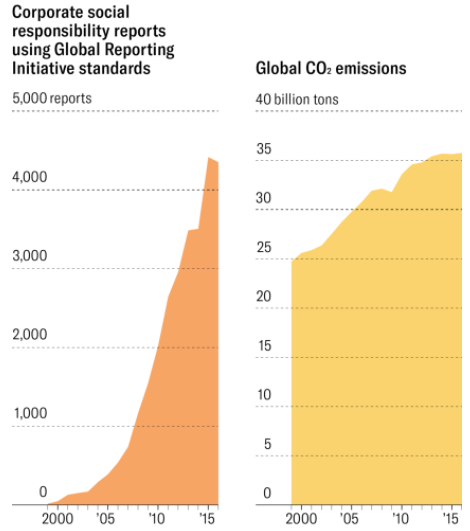

As the race towards sustainability gears-on, there seems not to be equal progress in winning sustainably for business, society and the environment. Whereas the number of organizations embracing sustainability strategies and sustainability reporting increases, the society and the physical environment do not reflect the same level of progress; the businesses seem to be smiling to the bank while the society and the physical environment pay the prize. This informed the notion that there may be possible over-selling of the sustainability issue – much paper work and publicity (on sustainability reporting) with very little impact on society and the physical environment. In some other quarters, it is believed that sustainability reporting is all about stakeholders’ impression management: reporting to secure legitimacy and stakeholders’ trust cum confidence.

Source: GRI Worldometer (Reported in HBR 2021)

The Letters

By the plethora of sustainability reports published annually across the global, reporting entities appear to be compliant and sustainable. Whilst there are several (competing) reporting guidelines, reporting organizations have large flexibility in choosing how to present their reports. Though there is significant convergence among financial reporting standards, with stricter rules, sustainability reporting enjoys more space for maneuvers. Thus, organizations find safe havens to hide their weaknesses behind the letters. Third party ‘independent’ verification now feature in most sustainability reports (supposedly to grow confidence and assurance). However, the assurances only do well to score the reporting organizations higher in terms of (paper) Performance. In a review of a certain organization’s sustainability report over a 6-year period, in a particular year’s report, the GHG audit revealed that the total GHG emission by the organization amounted to 12,219 tCO2e which is equivalent to 10yrs old 560,504.6 pine trees or 952.9 kilometers o forest. Though this down-side was duly reported, there was no follow up in the report of the succeeding years to track actions from the organization in remedying the impact of the GHG emissions which would have included tree planting or investment in forestation, in the quantum identified in the report.

The subterfuge of ‘Limited Assurance’ aids reporting organizations in hiding behind the Letters of the sustainability reports. The following lines were culled from the limited assurance report provided by one of the big 4 audit firms on an entity’s sustainability report:

“Our responsibility in performing our independent limited assurance engagement is to XYZ plc (real name, withheld) only and in accordance with the terms of reference for this engagement as agreed with them. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other that XYZ plc, for this report or for the conclusions we have reached”

The above statement clearly shows whose interest the purported ‘Independent Limited Assurance Report’ serves. But if the assurance reports would be of help, they must be reasonable, not limited. Again, it must not be the regular auditors (except they have the requisite skill set and technical prowess to afford reasonable independent assurance report in the interest of all stakeholders). This is not to disparage the regular auditors, but for reasons confessed by the same auditor referenced above:

“Where a limited assurance conclusion is expressed, our evidence gathering procedures are more limited than for a reasonable assurance engagement, and therefore less assurance is obtained than in a reasonable assurance engagement”.

Beyond LettersMaking sustainability performance and its reporting impactful to both society and environment requires concerted efforts and actions beyond the Letters, some of which can be summarized below:

- Convergence of reporting standards: – Whereas the GRI has been reckoned as the most widely used, there are still other standards like the SASB, including other regional and national standards. Thus, reporting entities exercise full discretion of what standards to adopt and what information to include on the reports. This polarity needs to be addressed so as to promote comparability of reports irrespective of who prepared them or where they are prepared from.

- Reasonable Assurance: – Independent reasonable assurance over sustainability reports is Key in driving positive social impact and promoting the reliability of published reports. The market concentration, wherein assurance services are reserved for the big four must be discouraged; end to end technical competence should allocate the assurance engagements rather than fame. It is also important that the assurance provider should, as a matter of public good, owe their responsibilities to all stakeholders, not to the reporting organization only.

- Increased Regulation: – Much attention is given to financial reports in terms of regulation than is given to non-financial reports. This is more pronounced in less-developed economies. There seems to be no attention on who reports, what is reported, how it is reported or what follows afterwards. Another area regulation would help is in setting of targets. Presently, entities in less-regulated climes set their own targets which most times are sub-optimal. Target setting should reflect prevailing national or international social and environmental pursuits.

Why it matters

Pay parity continues, though disclosed as required in sustainability reports; CO2 emissions continue to grow unabated, reporting entities merely reports, not much is seen in terms of impact that is commensurate with the level of disclosures; environmental degradation, plastic pollution, air pollution, water pollution, noise pollution and solid waste continue on the increase just as sustainability reporting continues on the increase. Beyond letters, it is important to read sustainability reports from the street, from the beaches; increase in sustainability reporting should reflect in reduced ecological losses and improvement in climate change issues. Sustainability performance should not only translate to better bottom lines, but should also serve to reduce the social cost of business. There is need to move sustainability beyond letters.

The CSR Arena is a CSR advocacy and sustainability-reporting-analysis champion. We encourage and celebrate effective CSR and positive social impact by responsible corporate citizens; we celebrate international best practices in sustainability reporting across different economic divides. Our goal is to realize the dream of development scholars that, ‘corporates, more than governments, would bring about the much needed sustainable development across the globe. We partner with FBOs, NGOs, CBOs, governments and corporates to spread the message of sustainable development and corporate sustainability. Our platforms bear tales of good corporate citizenship – grab the microphone that you may be heard. Contact: news@thecsrarena.com